Posted on January 18, 2019

Reshoring in Turbulent Times: Should I Stay or Should I Go Now?

Mentions of reshoring in the media have skyrocketed during the decade following the Great Recession as periods of high unemployment lend themselves to increasing the profitability, and probability, of reshoring. While the unemployment rate has dropped significantly as of late — most recently to 4.1%, the lowest rate since 2000 — reshoring remains a hot topic. In 2017 approximately 171,000 manufacturing jobs were re-shored to the US from economies previously considered low cost, up 2,800 percent from the low recorded in 2010.

However reshoring is a major decision for companies that requires serious examination of all related economic, political and business factors. So let’s take a look why companies might consider reshoring, what benefits and risks exist, what is Reshoring, Near-shoring and Back-shoring?

Reshoring typically moves production of products or services from developing countries to more developed countries, though not necessarily back to the same country as a company’s headquarters.

Near-shoring occurs when a company moves production closer to home, such as an EU-based company moving production from China to Turkey.

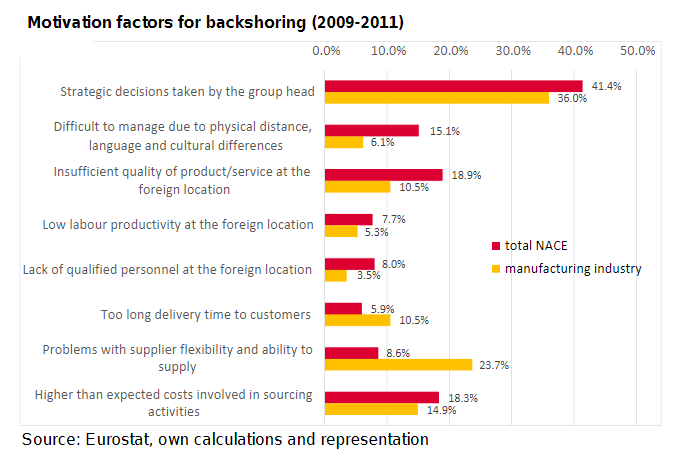

More frequently we hear about back-shoring, wherein an EU-based company moves production directly back to the EU. Indeed the EU itself is actively monitoring the situation with a research project – details available at https://reshoring.eurofound.eu...

Another way to break down reshoring is to look at what kinds of production are being moved. Reshoring of manufacturing production is most common, but reshoring services are also gaining momentum. For example, growing demand for customer service representative’s located in-country has increased the number of service jobs reshored to the UK. We have all seen service providers marketing UK based call centres for example.

While reshoring manufacturing production typically moves jobs out of China, reshoring service production tends to move jobs out of India. Why Is It Increasing? Like the growing consumer preferences surrounding customer service representatives, there are several reasons a company might consider reshoring all or some segments of production.

One commonly discussed reason is the changing cost of production in developing countries. Rising energy costs and wages in developing countries are increasing the cost of offshoring. Average hourly wages in China increased by 10% during 2017, roughly triple the pace of US overall wage growth during the same time period. Consistently rising costs are beginning to decrease the benefits of offshoring to China. Meanwhile, according to a 2014 study by the Boston Consulting Group, the cost of manufacturing in Mexico was estimated to be 4 percent cheaper than the cost of production in China

Cost structures are not only changing abroad, digitalization and improving technology can lower labour costs for companies producing domestically. Automation, 3D printing and improved processes, though a potentially costly investment at the start, can greatly reduce the cost of production in developed nations.

Another growing concern for companies with offshore production are the hidden costs of doing business over a great distance. Coordination between headquarters, shipping and transportation costs, and quality control all fall under this category. These hidden costs, once realized, can make offshoring unprofitable in some cases. Additionally, production in developed nations can facilitate easier research and development (R&D) and help protect intellectual property (IP). Innovation can slow when production is distanced from R&D as new ideas and procedures become more difficult to implement.

Manufacturing closer to a company’s market can also shorten time to market. In the case of IP protection, domestic production can reduce the risk of foreign suppliers becoming competitors by learning about the production process as they supply a manufacturer. US companies operating in other countries may also have a harder time protecting intellectual property in a foreign legal system than stateside.

What Are the Risks? However, there are certainly risks to reshoring as well. Companies considering reshoring should examine the cost of extracting operations (loss of or cost of transporting equipment, buying out contracts, etc.). Companies should also consider whether the necessary skills are available in the country to which they plan to re- or nearshore. Currently the UK is experiencing a skilled labour shortage, which could make reshoring production difficult.

A third consideration is whether your company is ready to invest in automation to reduce labour costs. Wages are rising in the UK, increasing the cost of labour. If the cost of labour is too great, companies that reshore need to consider the likely heavy near-term cost of investment. For this reason, companies might consider reshoring select segments of production, particularly segments that require greater quality control, IP protection, or specialized skill sets.

Should Your Company Consider Reshoring/Near-shoring/Back-shoring? In today’s unpredictable, whipsaw-like political landscape there is little clarity regarding possible tariffs and trade agreement negotiations. While corporate tax code changes and economic indicators offer some stability on which to base decisions, ultimate relocation determinations will likely rely on the outcome of EU & Brexit renegotiations and tariff resolutions. A wait-and-see approach, paired with preparation that allows companies to move quickly when the situation becomes clear, might make reshoring an attractive solution to companies looking to maximize profits, minimize cost, and minimize business disruption.